BY GLEN ADAMS

Basically, the only factor influencing

the price of gold is supply and demand.

Gold has been a much sought after commodity since civilized man first discovered it. Its unique properties of scarcity, beauty, and a store of value have made it the most enduring of all financial and/or industrial commodities. In one way or another, it affects all of modern man.

The most important financial function of gold is as a store of value. When paper money was introduced as a way to make every day transactions easier, gold for paper was a one-to-one trade, easily converted either way. The paper was basically a receipt for gold on deposit, and the amount of currency in circulation was directly linked to the amount of gold held. Eventually a fractional reserve system was developed which allowed banks to issue more paper money than they held in gold reserves. This let the economy grow and expand at a rate that would be impossible if all paper was required to have 100% gold backing. But, it also left the economy vulnerable to inflation. The amount of currency in circulation grew faster than the amount of goods and services that were produced. The purchasing power of gold, however, remained constant. Through the years, the amount of goods and services that, could be purchased with an ounce of gold have remained relatively stable. There are exceptions, of course, such as during 1979 and 1980 when the prices of gold and silver soared and their purchasing power was substantially increased for a short period of time.

When the U.S. went off the gold standard in the mid 1970’s, the link was broken, and the amount of currency in circulation could be expanded or contracted according to the needs of the economy. This was one of the factors that led to double-digit inflation in the late 1970’s and the resulting high precious metals prices.

Some people view gold as an investment, something to “buy low, sell high.” Others take a more conservative view and hold gold as long-term “insurance” against political unrest, inflation, or economic crisis. To this group, selling gold to take cash profits would be like canceling their car insurance and hoping they don’t have an accident. They may increase or decrease their holdings from time to time, but they always have a position.

Basically, the only factor influencing the price of gold (or any other commodity) is supply and demand. If there are more buyers than sellers, the price will rise. Generally, the demand-side of the equation will fluctuate more than the supply side and cause the changes in price. Supply wi11 change over time, but will remain fairly constant in the short term. Demand can change dramatically in a short period of time. If a major bank were to collapse, the number of gold buyers would immediately increase. Supply would not be able to keep up in the short term and higher prices would result. Most mines cannot increase production on short notice.

The same factors that have influenced the gold market during the past will continue to influence it in the future. The different factors do, however, become more important or less important at different times. For example, during mid-1980’s, traders all waited for the release of Thursday’s M-1 figures to see how much the money supply expanded or contracted. This was thought to be a good short-term indicator of inflation. Most traders totally ignore these figures today. Presently, the monthly U.S. trade deficit (it’s not a trade report anymore, it’s automatically assumed to be a deficit) has some affect on the value of metals, because of its affect on the value of the U.S. dollar against major foreign currencies. In the future, gold should continue to maintain its purchasing power and be a hedge against inflation in times of economic uncertainty. Long-term “gold bugs” will continue to protect themselves and short-term traders will brag about their profits and curse the markets when they lose.

How can gold or silver sell at a price below production costs? Number one, it is very expensive to open and close a large mine. Often, it is better to sell at a loss in the short term than to incur opening and closing expenses. Number two, most of the costs involved in operating a mine are fixed costs; they must be paid if the mine produces 100,000 ounces or no ounces. If the mine is producing, even at a loss, a good portion of the fixed costs are probably being met. If the mine is not producing anything, there is no income to meet at least part of the expenses. It is like a landlord with a $1,000 a month mortgage who can only rent the house for $800. He is better off renting it for $800 a month and having a $200 a month loss, than letting it sit empty and get no rent to pay the $1,000 mortgage. But obviously, he cannot do this forever.

By producing at a loss, mines can contribute to keeping the price of the metal low. If prices are down, supply is greater than demand. By continuing to produce, mines are adding to an already over abundant supply. Something must change in the demand-side of the equation in order for prices to go back up.

It is, of course, easy to see where the small-scale miner can nestle comfortably within the security of this ongoing dilemma. Regardless of the small day-to-day fluctuations in the overall gold price, the small-scale miner, properly equipped, can ideally continue to operate profitably and on a cost-effective basis. And due to the very nature of this scale of operation, this type of gold producer, unlike the major producers who deal in gold futures as much as 1 1/2 years in advance, can quickly react to the market opportunities as they present themselves, either by holding their gold or quickly selling it off, keeping in pace with either short-term rallies or major upswings.

By Dave McCracken

Raw gold creates an impulse inside of you that makes you want to possess it, to own it for yourself, to hoard it away, to treasure it as your own!

Not too long ago, while dredging with partners on the Klamath River in northern California, we located a very rich deposit, sometimes recovering as much as 24 ounces of gold per day. This was one of the best gold deposits I personally have ever located!

While some people are skeptical about the subject, the condition of “gold fever” really does exist. I know, because I have felt the heat and confusion on more than one occasion. I have written in the past that gold fever affects different people in different ways, depending upon the basic nature of their/your personalities. How much gold that is being uncovered also can determine the degree to which gold fever strikes. Some people get excited over recovering just a few flakes! What would happen if they uncovered untold riches out of a bonanza deposit; how would these same people react?

When my partners and I uncovered this very rich deposit, we started by finding about two ounces during the first 30 minutes of sampling. Because it looked so good, we decided to drop back on the pay-streak several hundred feet and dredge another sample hole. We recovered a pound of gold the first day we uncovered bedrock. There were pockets of gold deep enough and big enough that we stirred our fingers in it! We undoubtedly could have doubled our production if we had chosen to dredge efficiently, rather than spend most of our time googooling around together on the bottom, screaming at the top of our lungs, patting each other on the back, and uncovering the gold as slowly as possible to prolong the incredible excitement of uncovering a real treasure.

at the top of our lungs, patting each other on the back, and uncovering the gold as slowly as possible to prolong the incredible excitement of uncovering a real treasure.

After all, in the end the gold gets traded for money and spent or locked away. And all you have left is the memory of having found it. That is a memory I personally will never forget. It is a memory of an adventure that few people on this planet ever get a chance to experience. It is an experience that gets into your blood, goes directly to your heart and soul, and gives you a case of gold fever that will probably never be cured!

I have heard people, after locating rich deposits, express the wish that they did not have partners with whom they had to share. For me, I am really glad I had partners to share this experience with. Because the experience was so powerful, with so much generation of emotional energy, that it is almost impossible to express it to others who were not there.

More recently, while consulting in Central America, I had an opportunity to get my first look at real gold treasure! I have spent some time looking for it during the past and spent a lot of time thinking about being in the big treasure hunting game, but this was my first chance to see the real thing as it had come out of the ground. Wow!!

I saw gold and jade artifacts which had been created five, maybe six, centuries ago by people who had not even discovered the wheel! Artifacts so rich in detail, beauty and antiquity that they made my heart pound so hard that I could actually hear it. My body-heat came up enough to run sweat down my back. And my emotions energized to the maximum limit just at the thought of owning such things. No gold deposit ever affected me in this way!

I saw gold and jade artifacts which had been created five, maybe six, centuries ago by people who had not even discovered the wheel! Artifacts so rich in detail, beauty and antiquity that they made my heart pound so hard that I could actually hear it. My body-heat came up enough to run sweat down my back. And my emotions energized to the maximum limit just at the thought of owning such things. No gold deposit ever affected me in this way!

I am told this is called “treasure fever”.

Just like many people who get into gold mining, but never experience a really significant gold deposit, I think perhaps a lot of people get into treasure hunting, but never get a chance to really experience “treasure fever” the way it can really be. It is one thing to think about it, speculate over it, plan on it, and experience it on a subjective level. It is entirely another thing to confront priceless treasure head on, to find it unexpectedly—even when you were planning on it. Then you have to deal with the reality of having uncovered incredible riches.

There is something excitingly-beautiful about the aesthetic wave-length of gold as you locate it in its natural from. It creates an impulse inside of you that makes you want to possess it, to own it for yourself, to hoard it away, to treasure it as your own.

But finding gold which has been refined, perfected and crafted into artistic, beautiful, rich artifacts which were valued and hoarded and lost by people long ago, adds a value of antiquity which intensifies the personal emotional desire to keep the pieces for yourself. This is treasure fever!

I sympathize for treasure hunters or gold prospectors who are not prepared for it, who have not organized their program well, and who are (un)lucky enough to stumble upon real treasure!

I say “lucky,” because most treasure hunters today who find really significant treasures are very well organized, utilize modern equipment, and follow proven techniques. They generally are prepared for treasure when they find it. But, even the most successful and experienced treasure hunters will readily admit that they generally were not prepared for the amount of confusion and greed which resulted from uncovering real treasure!

Gold and treasure will test your personal integrity in a serious way!

While treasure fever, or gold fever, can have many negative connotations, it can also have a very positive affect upon people. Treasure fever adds spice to life, gives you purpose and makes life more interesting.

As gold prospectors, we actually experience the adventures most others only touch on lightly by watching the television!

- Here is where you can buy a sample of natural gold.

- Here is where you can buy a basic gold prospecting kit.

- More About Gold Prospecting

- More Gold Mining Adventures

- Schedule of Events

- Best-selling Books & DVD’s on this Subject

BY PETE H. McLAUGHLIN, Assayer

In the study of any subject, it is often helpful to step back and get the whole field in perspective before you try to sort out the details. Looking for lode or placer deposits is that field of study which locates the current resting place of gold, and raises the question:

“How did the gold get there?” The trail, when followed back, will take you some 10 billion years!

Current theory of the beginnings of this universe state that some 15 billion years ago, there was a single super dense point of energy which was incredibly hot and smaller than a proton. It exploded; and in a flash, produced photons which are particles of light. The photons collided and produced electrons, protons and neutrons of matter and anti-matter. The matter and anti-matter collided and produced photons.

This cycle continued as the universe expanded and cooled until it became too cool to support these reactions. This caused a final reaction between the matter and anti-matter particles that turned most of the mass in the universe back to photons and left the slight excess of matter which we now see as the planets and stars in the universe today.

At this point, four minutes after the start of the “Big Bang,” the mass of the universe is 76% hydrogen, 24% helium with trace quantities of lithium. The temperature is about a billion degrees and the universe is still rapidly expanding. None of the heavier elements had formed in this first “Big Bang,” because the conditions were not right. About a million years go by, and the hydrogen and helium clouds condense in space where chance caused slightly denser clouds of gas, gravity takes over and makes the cloud still denser. The pressure builds up and so does the heat; until finally, hydrogen fuses to helium and a star is born.

These first stars are called Population-III stars. As they burned up their hydrogen, they became denser and hotter, until they reached the temperature of 200-million Kelvin. Now, helium begins to react to produce beryllium and then carbon and oxygen. This is important, as all the oxygen you and I breathe, and the paper this story was written on, are made of the oxygen, hydrogen, and carbon that were formed in a Population- III star two to three million years after the beginning of the universe!

The carbon and oxygen reactions in a star are very rapid; and in a couple of’ centuries, the star is again heating until it reaches a temperature of around 800-million Kelvin, and new reactions take place that produce neon, magnesium, and sodium. A little more heat and you have silicon. A little more pressure, and the silicone becomes chlorine; and magnesium becomes aluminum.

The Population-III star now becomes so dense that the gamma rays which have supported its mass react with each other, and the star collapses and goes super-nova, spewing its mixture of chemicals into the interstellar medium. There are no Population-III stars left in our galaxy. All of them exploded some three to four million years after the “Big Bang.”

Population-II Stars, or how to make gold in your own nuclear furnace

The matter spewing out of Population-III stars floods the universe, so that stars forming four million years after the Bang are contaminated by heavier elements than were available for the Population-III stars. The Population-II stars bum their hydrogen to helium as the Population-III stars did, and begin to burn the heavier elements until they produce iron; at which point they reach the end of the line. If their mass were about that of our sun, they would become red giants; and as the outer surface cools, it can condense at a distance too far to be pulled back to the star, which is now a white dwarf. If the mass is heavier than our sun, things get very lively indeed.

More and more, matter in the core is converted to iron and cannot go any further. The reactions in the core cease; and as this happens, there is less and less radiated energy to support the surface of the star, and it collapses. For a brief period, measurable in minutes, the density of the star and its temperature rise beyond that needed to fuse elements heavier than iron. There is a flash of light brighter than the output of a whole galaxy of stars, and a super-nova occurs that will flash, expand and cool to nothing in a few-day’s time. In the middle of this maelstrom, small amounts of bismuth, lead, uranium and gold are formed and then scattered out between the stars in the resulting explosion.

After the super-nova, the Population-II star will become a black hole if it retains enough mass, or a neutron star. If the star is about seven times the mass of our sun or less, it will become a white dwarf.

Population-I Stars or, Home Sweet Home!

Now we get down to current history. Ten billion years after the beginning of the universe, most of the Population-II stars have super-nova’ed, and the interstellar medium is loaded with small amounts of the 96 elements available in nature today. A cloud of these materials, still containing mostly hydrogen, condenses and forms a swirling disk. The center pulls most of the mass into itself because centrifugal force is weakest here, and the mass heats up until fusion starts and our sun is born. The radiation from this new sun does the first job of concentrating gold for you, by driving off the lighter elements in the disk of matter around it. As the planets condense and develop a gravity field that pulls in more mass, the mass becomes richer in heavy elements, and lacks in the preponderance of hydrogen that the sun has. The closer to the sun the planet is, the more the heavy elements appear to be predominate.

At first, the Earth is relatively evenly-mixed and composed of hydrogen, helium, carbon, nitrogen, oxygen, neon, sodium, magnesium, aluminum, silicon, phosphorus, sulfur, argon, calcium, iron, and nickel and a trace of the rest of the 96 elements, including gold. As its mass increases, pressures and temperatures rise. The natural decay of thorium and uranium contribute to the temperature rise, and the core of the planet becomes liquid, allowing the heavy elements (mostly iron) to drain to the center of gravity. The lighter elements hydrogen, helium, oxygen, nitrogen, neon, and much of the sulfur boil off and are lost because the gravity of the planet is too weak to hold them.

As more matter is captured by the gravity of the forming Earth, the gravity-field strengthens and an atmosphere is retained. The molten iron in the core begins to flow, in rising and falling currents that act like a generator to produce electricity and the magnetic field of the planet. The silica, iron, calcium, magnesium, sodium and potassium to form the rocks of the mantle and crust.

Gold Deposits in the Mantle and Crust

Present theory is that gold and other heavy elements would have been evenly spread in the forming Earth. However, the percent of gold present in interstellar matter is extremely minute. As the core melted, gold would amalgamate along with iron and nickel. The silicates floated above the core and formed the mantle which extends from a few miles below the present surface to about 2,000 miles down. It is composed of iron and magnesium silicates called Olivine with minor amounts of other impurities like gold. The surface of the planet is called the crust and is about 20 miles thick under the continents. Below the oceans, the crust is much thinner or completely absent. The crust differs from the mantle in that the rocks are made up of the elements sodium, magnesium, aluminum, and calcium.

Gold is present in the crust and mantle in very low concentration. Tests on California granite show an average of 0.103 parts per million, which works out to 0.003 ounces per ton. T.K. Rose, in his book, “The Metallurgy of Gold,” cites a number of assays on rock samples taken from locations remote from known gold deposits. The values range from 0.03 ounces to 0.003 ounces of gold per ton.

High grade lode gold sites which have been worked in the past are the result of hydrothermal concentration or organic deposition.

Hydrothermal concentration is the leaching of deep mantle rock by water from the surface of the planet. Under the ocean, those geysers found during the last few years are evidence of this process continuing into the present time. Seawater seeps down into the mantle where it is heated and makes contact with the olivine rock. This rock contains small amounts of gold, manganese, and cobalt and larger quantities of iron and sulfur. These are leached from the rock and the heated seawater begins to rise until it finds a vent where it returns to the sea and deposits the sulfides of these metals as it cools. The process is the same on land; and many of the world’s gold deposits were created from this process. The hydrothermal solutions at work on land are evident at Yellowstone National park where “Old Faithful” spews its lode of mineral-rich water on the hour, and hundreds of hot springs and mud holes smell of the sulfur-rich mineral they are bringing to the surface.

Organic deposition is similar to the carbon recovery from leach solutions which is used so much today. Ocean water contains gold in varying amounts; but the average is something like 120 to 130 tons to the cubic mile of sea water. If this solution is passed through previous rock or gravels containing organic matter, some of the gold will be deposited on the carbonaceous material. The gold reefs of South Africa were probably derived from this process. T. K. Rose theorizes in his book that much of the gold deposited in sedimentary rocks was by the process of adsorption on carbonaceous material.

Where to Look

Gold is still where you find it. However, with the carbon heap leach process, the average value of profitable ore is now down to the .03 to .05 area under good conditions, and this is only 10 times the concentration of gold in average crustal rock. This makes it a little more likely that if you look diligently, you’ll be successful.

It is amazing that all the material of this planet, including the gold, was once the heart of a star; and it had to be blasted from that star by a super-nova before you and I could come along and make use of it as a planet to live on. But, these are the facts as best as the scientific community can work them out at this time.

- Here is where you can buy a sample of natural gold.

- More about gold

- More about how to prospect for gold

- Schedule of upcoming events

- For a more thorough explanation of gold mining techniques, checkout these informative books and videos by Dave McCracken.

BY ANDY MASLOWSKI

America has a lot of flakes – especially of the golden variety. It has a great deal of gold nuggets and dust too; and each year, prospectors and miners of all shapes and sizes search for gold from Maine to Alaska, and California to Georgia.

America has a lot of flakes – especially of the golden variety. It has a great deal of gold nuggets and dust too; and each year, prospectors and miners of all shapes and sizes search for gold from Maine to Alaska, and California to Georgia.

Many of these people prospect for gold as a small-scale prospecting or mining activity. But others make serious investments with mechanized equipment, and dig out a livelihood working placer deposits in stream valleys, terraces, beaches or dry concentrates.

Most of the gold produced in the U.S. comes from lode deposits. About 80% of the nation’s annual domestic gold supply is collected at its 25 largest gold mines. The remaining 20% is derived from about 175 other lode gold mines as a byproduct of processing base metals (chiefly copper), and placer deposits.

Estimating placer gold production is difficult to do. For 1994, the U.S. Bureau of Mines stopped “placer canvassing,” or collecting data about placer mines. The U.S. Geological Survey, Office of Minerals Information (OMI), which incorporated many of the duties of the disbanded Bureau of Mines, is expected to continue this policy. But even the Bureau of Mines had problems getting all placer gold information when it was reporting gold production, along with the various State agencies.

When the Bureau of Mines was estimating domestic placer gold production from 1990-1993, it placed the total at 1% or 2% of the nation’s yearly output each year. During the 1980s, the annual percentage was around 2% or 3%.

Overall, American gold production increased during the period from about 2.08 million troy oz. in 1984 to about 10.28 million troy oz. in 1995. In 1984, the Bureau of Mines said 2% of this annual yield was placer gold. That would put it in the ballpark of 200,000 oz. In 1993, when the U.S. produced a record 10.74 million oz., the Bureau estimated domestic placer production at 3,042 kilograms, or about 97,800 troy oz. This was slightly less than 1% of the nation’s reported gold production for the year.

It would probably be safe to say American annual placer gold production has generally been in the 100,000-200,000 troy oz. range during most of the past ten years. That’s a lot of nuggets and flakes! Although all of the main 14-producing gold states have streams that yield gold “color” or placer gold, almost all of them rely on lode mining for the vast majority of their gold. The exceptions are Oregon and Alaska — which is the leading placer gold-producing state.

It would probably be safe to say American annual placer gold production has generally been in the 100,000-200,000 troy oz. range during most of the past ten years. That’s a lot of nuggets and flakes! Although all of the main 14-producing gold states have streams that yield gold “color” or placer gold, almost all of them rely on lode mining for the vast majority of their gold. The exceptions are Oregon and Alaska — which is the leading placer gold-producing state.

The Alaska Department of Natural Resources, Division of Geological & Geophysical Surveys (ADGGS), estimated 141,882 troy oz. were produced in Alaska during 1995. About 95.6% of this was placer gold. The remaining 4.4% (6,230 ounces) was recovered from the newly-opened Nixon Fork hard-rock mine near McGrath. In 1994, before this mine was opened, all of Alaska’s gold came from placer mines – some 182,100 troy ounces.

The ADGGS reported there were about 145 mechanized placer mines operating in the State of Alaska in 1995. This was down from 182 mines in 1994 and 196 two years before. The placer industry, which employs many rural Alaskans, was expected to shrink further in 1996, due to flat gold prices and rising environmental concerns. There were an estimated 975 placer miners working in Alaska in 1995. This represented about 29% of all mining jobs in the state.

The ADGGS classifies placer mine size as follows: a large placer mine produces more than 2,500 troy oz. of gold a year; a medium-size mine yields from 650-2,500 oz. annually; and a small operation collects less than 650 oz. a year. Using this classification for 1995, the state had just four large-scale placer operations, five medium, and eleven small. These 20 placer mines produced about 50,700 oz. of gold in 1995, about 37% of the state’s total placer production.

The ADGGS classifies placer mine size as follows: a large placer mine produces more than 2,500 troy oz. of gold a year; a medium-size mine yields from 650-2,500 oz. annually; and a small operation collects less than 650 oz. a year. Using this classification for 1995, the state had just four large-scale placer operations, five medium, and eleven small. These 20 placer mines produced about 50,700 oz. of gold in 1995, about 37% of the state’s total placer production.

The large mines processed gold at a unit cost of $341/ounce., the ADGGS said. The medium operations did it at $245/oz. while the smaller mines required $231/oz.

While placer miners have to contend with winter weather in the mountainous areas of most states, those in Alaska have to deal with more severe conditions. A late spring or an early winter can shorten the mining season, causing placer mining firms to lose up to 25% or more of their annual gold production. Shorter daylight hours from autumn to spring are also a factor.

The bottom line: placer mining, is that it is not always an easy way to make a living. It’s not an easy way to get rich either, even with gold selling in the $380-$390 range. It’s even tougher with gold below $350.

While large-scale placer gold miners, most of whom are in Alaska, file production reports, many small-time miners probably never report their gold finds to any government agency. Nor are they usually required to do so, unless they sell their gold. Probably most prospectors never collect or sell more than one ounce of gold a year, so this requirement falls under the $400/year total for filing self-employment taxes with the Internal Revenue Service. Hey, is there any relationship to this $400 IRS requirement and the price of gold? Probably not.

Some miners who find larger quantities of gold may use it for bartering–trading their raw gold dust or small nuggets to directly purchase goods and services. This practice is still taking place in more remote areas of America, such as in parts of Alaska. Some miners use their gold in this manner as their “checkbook,” exchanging gold for food, clothing, tools, etc.

Besides Alaska, placer miners are also active in the western states; and to a lesser extent, in the southeastern states and in New England. Of these other states, Arizona, California, Colorado, Montana, Nevada, Oregon, Washington and Wyoming realize the greatest take of placer gold. And at least a few thousand troy ounces of gold are collected each year from these states combined.

Sometimes, large gold nuggets are found. In 1990, an 8-ounce nugget was found on the slopes of Pennsylvania Mountain, west of Alma in Park County, Colorado. It was named the Turtle Nugget. In 1995, a 27 oz. gold nugget was recovered from Strawberry Creek in the South Pass Mining District of Wyoming.

During the past decade, a number of other gold finds have been made with instruments the old 49’ers never had – metal detectors. Hobby and trade publications covering treasure hunting and gold regularly report on many of these new gold finds.

Thousands of modern “weekend warriors” and small-scale prospectors use their gold pans, sluices, dredges and metal detectors to look for gold with some success. For many gold bugs, getting out and looking for gold is the only way to satisfy their gold fever.

- Here is where you can buy a sample of natural gold.

- Here is where you can buy a basic gold prospecting kit.

- More about gold

- More about how to prospect for gold

- Schedule of upcoming events

- For a more thorough explanation of gold mining techniques, checkout these informative books and videos by Dave McCracken.

By Dave McCracken

One of the best ways to get beyond your own uncertainty of what natural gold looks and feels like is to get your hands on some of the real thing!

It is not unusual for a beginner to wonder about the difference between gold and the other materials found in a streambed or lode deposit. Sometimes a beginner will puzzle over shiny rocks, and quite often iron pyrites (fool’s gold) are mistaken for the real thing. In fact, this is so much the case that there is a story of an entire shipload of iron pyrite having been shipped over to England during the 1500’s — the yellow stuff having been mistaken for gold. So you can understand where it gets the term “fool’s gold.”

It is not unusual for a beginner to wonder about the difference between gold and the other materials found in a streambed or lode deposit. Sometimes a beginner will puzzle over shiny rocks, and quite often iron pyrites (fool’s gold) are mistaken for the real thing. In fact, this is so much the case that there is a story of an entire shipload of iron pyrite having been shipped over to England during the 1500’s — the yellow stuff having been mistaken for gold. So you can understand where it gets the term “fool’s gold.”

Gold is a brassy yellow metal. Once you have seen a bit of it in its natural form, you will no longer have much difficulty distinguishing it from the other materials that are commonly associated with it. Gold usually does not look anything like rock. It looks like metal; gold metal. If you are just starting and have not yet had the opportunity to see much gold in its natural form, there are three easy tests which will help you va1idate your discoveries one way or the other:

Glitter Test: Gold does not glitter. It shines. Sometimes it’s bright; sometimes it’s dull; but very seldom does it glitter. The thing about fool’s gold (pyrites or mica), is that because of its crystalline structure, it is usually glittery. Take the sample and turn it in your hand in the sunlight. If it is gold, the metal will continue to shine regularly as the specimen is turned. A piece of fool’s gold will glitter as the different sides of its crystal-like structure reflect light differently.

Hardness Test: Gold is soft metal, even more than lead. It will dent or bend when a small amount of force or impact is applied to it. Pyrites, mica and shiny rocks are generally hard and brittle. Just a little amount of pounding will shatter them. Natural gold almost never shatters!

Old-timers used to bite on a specimen to test if it was gold. This is another way of testing the larger-sized specimens. However, keep in mind that the larger-sized piece of gold is worth a great deal and the resulting tooth marks could lessen its value. If you find a piece of gold big enough for you to bite on, you will have little doubt that it is the real thing, simply because of its nature and its weight.

But if you are still uncertain of your find, you might try using the sharp edge of a knife and gently press in on the specimen in a place which is less likely to be noticed. If it’s gold, an indentation can easily be made into the metal with the blade of your knife. You will not dent the surface of a rock or iron pyrites.

Acid Test: Nitric acid will not affect gold (other than to clean it), whereas it will dissolve most of the other metals found within a streambed.

Acid Test: Nitric acid will not affect gold (other than to clean it), whereas it will dissolve most of the other metals found within a streambed.

Nitric acid can be purchased from some drug stores or prescription counters. It can sometimes be found where gold mining equipment is sold.

If you question whether your specimen is some kind of metal other than gold, immerse it in a solution of nitric acid. If your specimen is gold, it will remain rather unaffected. Almost any other kind of metal will dissolve in the acid.

However, nitric acid will not affect iron pyrites or mica (fool’s gold), but those are brittle and will not pass the hardness test.

CAUTION: Nitric acid can be dangerous to work with. Precautions must be taken to prevent harm to yourself and your equipment when working with it.

One of the best ways to get beyond your own uncertainty of what natural gold looks and feels like is to get your hands on some of the real thing. Once you have experienced real gold, you are much less likely to make mistakes.

- Here is a link where you can buy a sample of natural gold.

- Books & Videos by this Author

- More About Gold

- Digging for Gold

- Dredging for Gold

- Training Events

BY MARK JONASSON

Gold. Just the word strikes up many images in the mind: gleaming bars in a vault, Old-49’ers in a rough-and-tumble boom town, a mine shaft deep in the earth or prospectors squatting beside a mountain stream oscillating their gold pans….

Gold. Just the word strikes up many images in the mind: gleaming bars in a vault, Old-49’ers in a rough-and-tumble boom town, a mine shaft deep in the earth or prospectors squatting beside a mountain stream oscillating their gold pans….

Not long ago, Tom, Randy and I developed a case of a highly-contagious and debilitating fever, gold fever. Because our vacations all coincided, we decided to spend the time prospecting. We packed up and, pans in hand, headed for the Mother Lode Country in California. Our plan consisted of searching areas of the Merced River and several forks of the American River.

Gold has been prized from antiquity because of its scarceness and its inherent qualities. These inherent qualities, like its ability to be hammered paper-thin, its ability to be drawn into hair-thin wires, its weight–19 times heavier than water, and resistance to corrosion, have made gold the most sought-after metal throughout history. As far back as 4,000 B.C. the Egyptians were fashioning artifacts from gold. Gold is the first element mentioned in the Bible (Genesis 2: 10-12). Gold played an important role in the social and religious structure of the Inca and Aztec civilizations of Latin America.

More recently, the gold rushes beginning in the early 19th century in the southeastern United States, followed by the great California rush of 1849, and by later strikes in the Rockies and Alaska, have kept gold fever smoldering to the present day.

More recently, the gold rushes beginning in the early 19th century in the southeastern United States, followed by the great California rush of 1849, and by later strikes in the Rockies and Alaska, have kept gold fever smoldering to the present day.

Part of the recurring interest in gold is the estimate that over 80 percent of all existing gold worldwide has yet to be discovered.

Because of its weight, a lot of gold takes up just a little space. For example, a cubic-foot of gold weighs more than half a ton and the gold would be worth over $7.5 million dollars!

Knowing where to look for gold is probably responsible for 97 percent of the success that a prospector experiences. There are several good books that will get beginning prospectors started right. Dave McCracken’s Gold Mining in the 21st Century is probably the best. Two other books are; Gold Digger’s Atlas by Robert Neil Jonnson, and Gold! Gold! A Beginners Handbook And Recreational Guide: How To Prospect , by Joseph F . Petralia.

The areas of greatest-known gold concentration in the United States are in the Sierra Nevada and Rocky Mountain ranges. The Klamath Range in Siskiyou County, California remains quite active for small-scale gold prospectors even to this day, especially the area surrounding Happy Camp. Sufficient concentrations of gold were also mined from 1830 to 1840 in the Appalachians, as well as the mountains of Vermont and New Hampshire, to warrant an interest, particularly at current price levels for gold.

In 1986, California experienced a snow pack and spring runoff that were exceptional. The flow of the American River near Auburn, California became so great that colossal cement pilings and support slabs were slapped aside by the water as if they were empty cereal boxes. Even months after the high water, evidence of the tremendous force could still be seen on and around the American River Bridge near Auburn. The unusually high water turned many streams and rivers into raging torrents. This forced more gold out of hiding, and made for a tremendous prospecting season. Even so, reading the stream and bench placers properly can mean the difference between mediocre and memorable prospecting results.

In 1986, California experienced a snow pack and spring runoff that were exceptional. The flow of the American River near Auburn, California became so great that colossal cement pilings and support slabs were slapped aside by the water as if they were empty cereal boxes. Even months after the high water, evidence of the tremendous force could still be seen on and around the American River Bridge near Auburn. The unusually high water turned many streams and rivers into raging torrents. This forced more gold out of hiding, and made for a tremendous prospecting season. Even so, reading the stream and bench placers properly can mean the difference between mediocre and memorable prospecting results.

Another very large flood storm really tore up the area around Happy Camp in 1997.

In addition to choosing a potentially profitable geographic area, the prospector must also choose the correct area of a streambed to work. Gold settles almost immediately where water-speed slows down: behind boulders, at the bottom of a riffle section and on the inside of river and stream bends. Even though stream placers can be productive, do not overlook bench placers. During spring, high-water bench placers are often “restocked.”

Basic prospecting gear can be purchased for less than a tank of gas, unless you are riding a motorcycle, and should last indefinitely. Useful tools for prospecting, some of which you may already have at home, include: a bucket, coffee can, garden trowel, tweezers, old spoon, whisk broom, pry bar, magnet, a sifting device and shovel. You will need one small vial or zip-lock baggie to store the gold you find, a crevice tool, and of course a gold pan. These last items may be purchased at a rock, prospecting shop or from the Internet.

I suggest you purchase a high-impact plastic gold pan; it is lighter, very durable, and the black, blue or green color allows greater contrast of the gold against the darker background. Most plastic pans have traps and riffles molded into them to aid in gold recovery.

The mornings and evenings of our prospecting trip were cool and the warmth of the campfire felt comforting; but the days, and particularly the afternoons, were blistering-hot. Because we were in close proximity to water, coping with the heat was relatively easy. Not only did we jump in every half hour or so to cool off, but we soon began prospecting entirely within the river. It is amazing how much gold you can find just swimming around with mask and snorkel, while fanning light gravel from cracks in the bedrock!

During the first several days of our gold trip, one participant developed such an increasingly acute gold fever; that in an effort to not waste a moment on creature comforts, he began panning in mid-stream while almost completely submerged. All prospectors in our group soon were diving down and bringing gravel up from the bottom of the river. We sat around the campfire at night just imagining how much more gold we would have recovered had we brought along a suction dredge on our venture. It was a great trip!

Prospecting is a pleasant activity for me. I often take an afternoon or weekend, and enjoy the gold I find as well as the prospecting. Gold prospecting can be done on a solo trip, a family trip or with a large group. People of all ages can prospect for gold and enjoy the search. You will enjoy prospecting, and the exercise in the out-of -doors is just an added plus.

- Here is where you can buy a sample of natural gold.

- More Gold Mining Adventures

- More about gold

- More about gold prospecting

- Schedule of upcoming events

- Books and Videos by Dave McCracken

BY DR. ROBERT C. BRIGHT

Gold has been known to possess a warm energy that brings

soothing vibrations to the body to aid in the healing process

Think, does anyone completely understand the importance of energy and how energies affect the body? Does anyone realize the significance and ramifications involved spiritually, mentally and physically when the body adapts to different energy forms, patterns and forces? In generations past, the techniques and philosophies of health, along with experiments with energies, often included various metals and their effect on the body. The effects of gold are subtle, but definitely apparent.

When studying energies, we find that in some older societies and older countries, gold was used for healing or was thought to have had healing properties. They used, at that time, 24-karat gold, not gold alloyed with other metals. Other metals change the properties of the pure gold and the vibrations emitting from it. If a person took pure gold and put it on an infection or a sore spot, it was said to help heal the wound and control infection. It was considered that gold possessed an energy that brought warm, soothing vibrations to the body to aid healing, for when the body relaxes and the blood vessels in the cells aren’t as constricted, blood can move through the tissue spaces more easily. Since all healing is the growth of new cells replacing the dead cells, the body would heal much better and faster, just as those people who have learned to meditate and use the other various arts of relaxation can testify.

In studying the different uses of gold in the healing arts, we find that for thousands of years acupuncturists used silver and gold needles. It was said that gold is warm and stimulating while silver contains a cold, inhibiting factor.

In some areas of India, if a man had hemorrhoids, he would wear a silver ring around his left little finger. In studying reflexologies and acupuncture meridians and other related sciences, you will find that the little finger reflexes with the anal area of the body, thus silver would have a tendency to make their tissues contract and help to cure the hemorrhoidal condition, as hemorrhoids are a malfunction of the muscles of the blood vessel walls. Today, modern acupuncturists use only steel needles. The art of feeling and knowing the different vibrations caused by various metals within the body’s energy systems has been virtually lost. Even today, however, there are some acupuncturists who will use a gold bead, sometimes only a 64th of an inch in diameter. The bead is placed on a small square of adhesive tape. It is then taped to an acupuncture meridian that is low in energy. The gold bead will pick up more energy from the surroundings and give the meridian a boost.

Colors also have an influence on health. Color is vibration; some colors are healing, some are stimulating, and others work against the healing process. Gold is warm and dilates the tissues and relaxes the injured area, permitting repair to be a little faster. Some kings and queens would wear a crown of gold on their heads or a gold band that would go around the entire head. In studying reflexology and acupuncture, you will find that the electrical meridians of the body are the electrical circuits of the body and are influenced by gold. Gold also can be used as a sort of jumper wire that allows the energy to go from one meridian that is normal and strong to one that is weaker and not functioning as well. It gives power to the weak or shocked meridians. Thus, it helps the body to heal itself in many respects.

Also, I found that colored stones were used for their healing properties as well. For example, a diamond would be cut so that it created prisms which would break the sunlight into different vibrations. These vibrations would be used by the body for healing. Remember, the body does the healing, not the medicines or chemicals or vibrations or anything else. All healing is a growth of new cells taking the place of old dead cells. Nothing can heal unless it can make cells.

Gold is believed to have a relaxing effect. When you feel something made of 24-karat gold it will have a soft, velvety texture. Nothing feels like pure gold. But it loses its effectiveness when combined with other metals.

Royalty put diamonds and emeralds in their crowns; they put rubies and other precious stones around their bodies. What made them precious? The fact that they helped heal and ease pain in the body. Only kings, noblemen and merchants could afford such luxuries as crowns, rings and bracelets. Gold and precious stones were not made for adornment at first, but were used as a preventive technique as well as a curing aid, adding energy to that part of the hand which reflexes areas of the body experiencing health problems.

Other minerals also have an effect upon the body. Here’s an experiment which will prove to you that your body has an influence on metal. Take several small pieces of metal: a regular steel sewing needle, an iron nail, a piece of copper, some silver, gold, and other types of metals. Tie a piece of string about six inches long to each of the pieces of metal, then take one of those pieces of string with metal tied to it, and hang it like you would a pendulum. Stand facing north, holding the string about a foot out in front of you. The piece of metal at the end of the string should be about level with your belly button. Just hold it there. Pretty soon you will begin to see it move or swing in certain directions. After you observe which way it swings, make a note of it. Face south, and you’ll find that it has a different swing. Try facing east and notice the difference again. Face west and notice the difference. Remember, it’s the same piece of metal, the same body, the same spot, but by facing in different directions you will find the metal pendulum will swing in different directions. The pendulum may swing in different directions for different people. Do that with each of the different metals you have. Your body and the environment have a definite effect on the metal. Likewise, when the metal touches you, your body has a reaction to the metal as well.

So, in conclusion, many of the ways of the past have been lost but not forgotten. Energies do exist; they do affect the body. Gold is precious, and its power and energy can be felt. Just put a pound of it in safe keeping and notice how good you feel-spiritually, mentally and physically. However, knowledge of energies and how they affect your health is more valuable than gold. If you don’t believe me, just ask a rich man who has lost his health.

- Here is where you can buy a sample of natural gold.

About the author: Dr. Robert C. Bright is accomplished as an author and in the healing sciences. To obtain more information on the subject of human energies, his book, LAN- GUAGE OF THE CELLS, is available through The Family Health Center; P.O. Box 32778, Phoenix, AZ85016. Dr. Bright has been a practicing Chiropractor since 1953. He has also studied Energy Forces: Od (pos. + and neg. -), Qi (Yin/ Yang) Chinese, Prana (Ida and Pendula) Indian, Reiki (the laying on of hands) Japanese, Kundalini, Energy and magnets (pos.+ and neg.-) American. Dr. Bright has studied Divine and Spiritual Healing, and has studied with numerous experts in the fields of Bone Setting, Muscle Therapy, Acupuncture, Reflexology, Radionics, Soft Tissue Therapy, Motion Palpitation, Color Therapy, Water Therapy, Sound Therapy, Vitamin Therapy, Hypnosis, Nutrition, and more.

“Although gold is one of the rarest of the elements,

it is also one of the most widely distributed.”

Among all the minerals — and there are literally hundreds of them — gold long has played a unique role. Man’s fascination with gold goes back to the beginnings of recorded history.

Among all the minerals — and there are literally hundreds of them — gold long has played a unique role. Man’s fascination with gold goes back to the beginnings of recorded history.

Although gold is one of the rarest of the elements, it is also one of the most widely distributed. It is ubiquitous in nature, found in every continent and on most of the world’s islands.

Gold is an enduring material, resisting corrosion in even the most hostile environment. In consequence, scientists estimate that of all the gold ever wrung from the earth and converted into metal, at least 90 percent still can be accounted for in bullion bars, coins, jewelry and objects of art carefully stored today.

Gold is remarkably malleable. One ounce of gold can be spun out into fine wire stretching many miles. Gold’s marvelous reflecting power has allowed it to be used in spacecraft as a shield from the enormous heat of solar rays outside the earth’s atmosphere. Its thermal and electrical conductivity exceeds those of base metals.

Were gold less expensive, these attributes would ensure its use in many industrial applications. But because of its rarity and its value in monetary, ornamental and artistic applications, the price of gold discourages its use except in applications where its properties are indispensable. Of all the gold marketed in recent years, about 8 percent has been consumed in electronics (largely for contact points) 4 percent has been used in dentistry and another 4 percent has been consumed in strictly industrial applications. Far more gold is fabricated into jewelry each year than into these other more mundane areas.

Because only one-sixth of the gold supply is taken by industry, the market is governed primarily by the metal’s perceived function as a store of value (including jewelry).

Gold’s strong price-performance has stimulated a boom in exploration for gold bearing deposits. Because prospectors have been combing the world’s mountains, plains and rivers for gold over many centuries, some might suppose that most gold deposits long since have been found. But instead, the exploration-boom is resulting in major discoveries of new deposits in every continent and many offshore islands. In addition, resources in mines that have been producing for decades have been extended substantially.

A striking example is the gold mining industry of the United States. The state of Nevada is now producing more gold annually than California ever did.

Similar expansion is under way in Australia, Brazil, Canada, Chile, Papua New Guinea and many other countries. South Africa, which long accounted for more than half the world’s gold production, continues to produce massive amounts of the metal, but it no longer dominates the industry as it once did.

Some have suggested the rising tide of new gold production in time will swamp the market, forcing prices downward. Certainly this would be the case in other commodities if supplies rose sharply. But gold is different. In the gold market, the new mine production each year is only one part of a complex supply pattern. Most of the gold that ever has been mined still is available as bars, coins or readily recyclable jewelry. At a high-enough price, this gold — whether held by individuals, corporations or central banks — is potentially part of the market supply. This was clearly the case in 1979 and 1980 when prices rose sharply. And it has been true subsequently, as central banks of debt-ridden governments have been liquidating at least a portion of their gold reserves.

Currently, gold production is less than 2 percent of the potential gold available from previous production — a unique situation that does not apply in most other commodities. Given political or military uncertainties, or high rates of inflation arising from economic mismanagement, the demand for gold could accelerate, absorbing not only the current new mine production, but also reaching out for part of the accumulated stocks from yester-year. To coax this gold back into the market might require sharply rising prices — as it did in 1979 and early 1980.

Now that the price of gold is no longer tied at a fixed rate to any currency, the one certainty is that the price will fluctuate, and at times, perhaps very erratically. Yet gold’s beauty and its strong roots in mankind’s traditions combine to assure us that it will continue to play a significant role in human societies.

Other metals are subject to very different influences than is gold. For the most part they are highly sensitive to the swings in the business cycle. Indeed they tend to exaggerate those swings, rising more rapidly in periods of expansion and falling more precipitately in periods of contraction.

Industrial society’s dependence on these non-renewable resources — the metals — has given rise to recurrent concern about imminent exhaustion of known supplies. The consequence has been that numerous studies have been undertaken in an effort to ascertain how long supplies are likely to be available. In the interest of generations yet unborn, strong measures are advocated to conserve resources and to maximize recycling.

But most appraisals are based on what we now know. The high rate of discovery of recent years is not going to end suddenly. New prospecting techniques — electro-magnetic surveys, soil sampling and other procedures — are multiplying the possibility of detecting deposits that do not outcrop on the surface. Enormous resources exist under the ocean deep — perhaps not viable in today’ s markets; but they will constitute significant potentials for future supplies. In my judgment, the bleak prospects are not going to develop in the foreseeable future.

Gold is very different from other metals. The demand for gold largely revolves around its role as a store of value. Public perceptions affect that demand very strongly. One might say that gold is mankind’s security blanket, affording a feeling of abiding value, a sure haven in a period of economic storm. For other metals, the needs are physical, where for gold they are largely psychological.

- Here is where you can buy a sample of natural gold.

- More about gold

- More about how to prospect for gold

- Schedule of upcoming events

- For a more thorough explanation of gold mining techniques, checkout these informative books and videos by Dave McCracken.

BY LAWRENCE WANDELL

Gold is said to be so rare that the world pours more

steel in an hour than it has poured gold since time began.

Gold is one of the world’s most precious metals

All of the gold in the world could be compressed into an 18 yard cube, which is about 1/10 the mass of the Washington Monument

It is recorded that only 88,000 tons of gold have been taken from the earth since recorded history, leaving far more yet to be discovered.

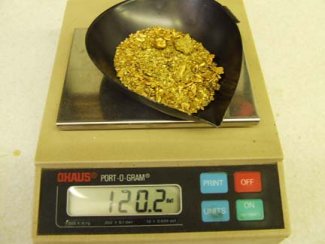

A one ounce gold nugget is more rare to find than a five carat diamond. The amount of gold nuggets being found in the world is less than one percent. Even though gold is rare, it is far easier to find than winning a major state lottery. Because of its rarity, a gold nugget can be worth three to four times its value of gold. An authentic gold nugget has long been considered a gem stone because of its rarity and beauty.

Gold is so heavy that one cubic foot of it weighs half a ton. Gold is six to seven times heavier than other materials that equal its size. The largest gold nugget found in the U.S. weighed 195 pounds; it came from California.

Gold can be hammered into sheets so thin that a pile of them an inch high would contain more than 200,000 separate sheets. Gold can be hammered so thin that sunlight can shine through it

A single ounce of gold can be drawn into a wire 60 miles long.

In every cubic mile of seawater there is 25 tons of gold! That’s a total of about 10 billion tons of gold in the oceans; however, there’s no known way to economically recover it.

Gold is considered one of the most important metals in jewelry making. Gold is so soft it is seldom used in its pure form. Jewelry that is marked 10K is made of 10 parts gold and 14 parts of another metal. The hardness of pure gold (on moh’s scale) is 2 1/2 – 3; the melting point is 2,063° F; specific gravity is 19.32, and tensile strength is 19,000 psi.

Gold can be transmitted from platinum by nuclear reaction. But because of the rarity of platinum, it is far too costly.

The United States government banned private ownership of gold which lasted 41 years, then lifted it on December 31, 1974.

Gold reached an all time high of 870 dollars per ounce in 1980.

South Africa is the largest producing gold country in the world today.

An ounce of gold is based on troy weight, 20 pennyweights or 480 grains. A pound of gold is 12 ounces while most other non-precious metals are based on the standard avoirdupois scale of 16 ounces to the pound; and 16 grams to the ounce.

Gold is chemically liquefied and injected into the muscles of thousands of rheumatoid arthritis victims in the U.S., and it is said that the treatment is successful in seven out of 10 cases.

Gold is used in window glass and astronaut helmets to reflect off infrared rays while allowing sunlight to pass through, and at the same time keeping it cool.

Gold is inactive chemically and is not affected by air, heat, moisture and ordinary solvents.

The largest gold mine in the U.S. is the Homestake Mining Company in Lead, South Dakota.